One of the most difficult and complex areas of probate litigation and estate administration in Florida is claims from an an ex-spouse. In a typical divorce, marital assets and debts are divided between the two spouses.

One of the most difficult and complex areas of probate litigation and estate administration in Florida is claims from an an ex-spouse. In a typical divorce, marital assets and debts are divided between the two spouses.

Personal and financial records are usually one of the starting points for any litigation in the Florida Probate courts. However, it’s also the type of information that most people would hope to keep private.

In certain cases concerning probate and estate administration in Florida, the victor often times can receive attorney’s fees and other costs associated wtih the case. But before they do, they must “move” for it, orsubmit a written request to the court clarifying the amounts and reasons they believe they are entitled to such an award.

According to media reports: 38-year-old Matthew Messier, a San Francisco Police Officer, appeared in court on Friday after pleading guilty to a felony count of lying about his assets. He faces up to five years’ probation and a year in jail.

Do to the high federal tax rates on capital gains (not to mention the increase in 2013, bumping those in the highest tax bracket up by 5%), many are looking for ways they can save on their capital gains income. Charitable Remainder trusts in Florida, sometimes written as CRUTs or CRATs, are the perfect tool for such goals.

In a recent Ohio probate case, the estate of a wealthy decendent, estimated to be worth over $12 million, was hit with a late-filing penalty of over $1 million, nearly 10% of the estate’s value. What was the reason? The probate attorney handling the case failed to file the tax returns on time.

When a person passes away in Florida, unless the value of that person’s estate is extremely negligible, Florida Probate Law mandates that a personal representative (sometimes called an executor of the will) be appointed to administer the Florida estate. A Florida personal representative will be appointed by the Florida probate court regardless if the decedent passed away with a will, or without a will.

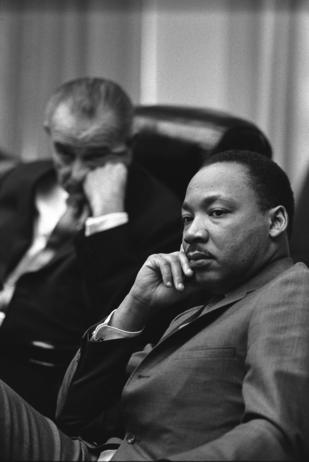

According to media reports: An ugly family battle over the Rev. Martin Luther King Jr.’s personal Bible and his Nobel Peace Prize medal is to play out in an Atlanta courtroom this week…

Even with the recent federal court ruling mandating Florida county court clerks to issue marriage certificates to same-sex coulpes (link here), there are still only 22% of the people in Florida living in so-called “traditional family households.” In fact, in the US as a whole, there are approximately 5.5 million ‘unmarried partner’ households.

Before you ask yourself if you should, the first question to ask is if you can. The only reason for one to have an irrevocable life insurance trust in Florida is if they are insured by one or more life insurance policies. Your local Deer Field Beach Wills and Trusts lawyer can tell you, the Florida Irrevocable Trust works the same as most other trusts. It is a contract is between the trust creator (“grantor”) and a trustee to administer the property, or in this case, Florida insurance contract for the benefit of some named beneficiaries.