Facebook’s Zuckerberg Leads Way in Charitable Giving – with Limited Liability Company

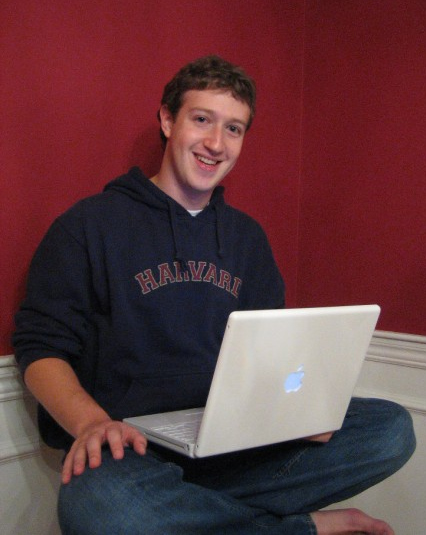

In Florida, a lot of estate planning attorneys write charitable trusts for their clients. Many times, a charitable remainder trust may make sense for those that are charitably inclined. There are, however, those trust lawyers or estate planning attorneys in Palm Beach who don’t believe a charitable trust is worth creating. Why? Because of the control and money you have to give up in the name of an income tax deduction. There are those lawyers who, to the contrary, recommend that you KEEP your money, DON’T create a charitable trust or a charitable remainder trust, and give money, or shares of appreciated property, annually as you wish. But out in California, Facebook’s Mark Zuckerberg and his wife, Dr. Priscilla Chan, are taking charitable giving to a higher level. And not only in dollar figures, but in the way they make their charitable donations.

Zuckerberg & Charitable Trusts

- Zuckerberg, and his wife Priscilla Chan, have pledged $3 Billion over the next ten years for preventing, curing or managing diseases. To read the New York Times story, click here.

- What may be interesting to estate lawyers in Florida is that Mark Zuckerberg is not using a private foundation or charitable trust to give back to society. No, he is using a limited liability company, a private entity, for his charitable giving. Here is a New York Times article on Facebook’s Zuckerberg and Priscilla Chan’s limited liability company and their charitable gifts: http://www.nytimes.com/2015/12/03/technology/zuckerbergs-philanthropy-uses-llc-for-more-control.html

- In Florida, many business lawyers create limited liability companies almost every day.

- Florida has a revised limited liability company law, or act, which you can read for free at this link online by clicking here.

- Many times, a Florida LLC can be used to hold real estate or a business or venture.

- Zuckerberg’s use of an LLC for charitable giving is novel and creative. Why?

- No one knows for sure, but the guess among some estate lawyers is that he is so wealthy, that the income tax deductions for his charitable giving may not be used.

- So, the argument goes, why create a charitable remainder trust or private foundation?

- In the end, hats off to Mark Zuckerberg and his wife Priscilla.

- They have pledged to give 99% of their Facebook wealth back to society. Amazing. And admirable.