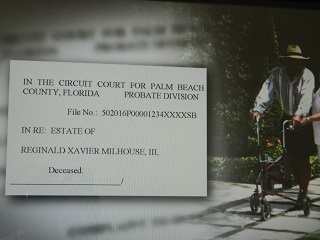

5 Signs of Financial Abuse of Your Parent: a look at financial exploitation of the elderly in Florida

Some call it elder abuse or financial exploitation, or elder exploitation. Some in Palm Beach county may refer to this financial abuse Florida as financial crimes against the elderly. But what we are talking about, and what many probate lawyers Palm Beach must deal with, is an older client, such as a senior citizen, being taken advantage of financially. In Florida estate or probate circles, this may be referred to as civil theft, conversion, and even larceny. In Palm Beach Countyand indeed Florida, there are elder laws which protect our seniors and permit them to filecriminal charges against financial predators Florida, as well as seek civil remedies ordamages, such as the return of their money in probate court or the civil division or trial division of our court system.

5 Signs That Mom or Dad May Be Financially Exploited in Florida

- Power of Attorney Mis-Use. The power of attorney document in Florida can be one of the most dangerous documents in the wrong hands. Is the person who has your Power of Attorney Florida running to your Boca Raton bank account and transferring money to his or her own account? Is your Power of Attorney driving to the Boynton Beach bank and putting her name on the account and making it a joint bank account Florida? A power of attorney document or Florida POA is supposed to be used for your parents’ benefit. It’s not a license to steal. Watch out for that.

- Changing the Deed on the Florida Home. Is someone asking your mom or dad to “sign” something to “protect” the homestead? Or, perhaps someone is asking your parent to “put their name on the deed” so they can pay your bills? Be leery. You can pay bills with “auto pay” and “auto debit” and your bank can help you with this. Or, your trustee of your Florida revocable trust can pay your bills. Placing someone’s name on a Florida deed is a gift: it’s a transfer of an interest in Florida real estate. Do you really want to give away your home or give up an interest in your Lake Worth residence? You don’t need to do that to “protect” it or to pay bills. You can also leave someone your home under your will or Boca Raton revocable living trust.

- Large “Gifts” in a Short Time. Did someone give away a very large amount of money or put someone on ALL their financial accounts like Florida bank accounts, IRAs, brokerage accounts and mutual funds in a very short period of time? Be careful if three things occur: a) one, if the person who is having their name placed on all your mom or dad’s bank accounts is “new” to them, new in their life, or is returning to them from being away; b) is mom or dad making DRASTIC changes to their Florida estate planor bank accounts Florida, like putting this new person’s name on all their savings?; c) if mom or dad is making large gifts to someone right away, out of the blue, with no history of prior gifts, that’s a warning sign. Why, all of a sudden, is mom or dad making large gifts? Why would mom give away, say, her life savings, which took 40 or 50 years to accumulate, in one month? Why would dad put an old girlfriend who resurfaces after years away, on all his bank accounts, which represent 80% of his liquid net worth, when he has a detailed Florid Estate Plan with a will, revocable trust and different beneficiaries?

- Mom or Dad Didn’t Tell Anyone. Did mom or dad give away money or “loan” moneyto someone like a distant cousin or brother or sister and not tell anyone? If mom or dad is not telling their accountant or CPA, Boca Raton estate attorney, or their children who they love and trust about large gifts or documents that someone asked them to sign, start asking questions. Could it be harmless? Sure, but get the facts. Be very weary if your mom or dad tells you that they “signed something” but don’t quite remember what it was and it was NOT prepared by their long standing, trust worthy Palm Beach Gardens probate attorney.

- Isolation. Not communicating with mom or dad in a long time, or their isolation, can create a “crack” for financial predators to squirm in to. If mom or dad just lost their spouse, or moved, or lost their friends or best friend, take an interest in mom or dad’s surroundings and day to day. Always be cautious if there are new “friends” in their life after a period of not hearing from them, and the new “friends” seem to be very interested in mom or dad’s legal or financial matters. Likewise, it raises questions if, after being kind of alone, if a new “friend” or “neighbor” is, all of a sudden, on the power of attorney, driving mom to the Jupiter bank. Could it all be innocent? Sure. But financial exploitation is real in Florida and someone needs to ask questions.