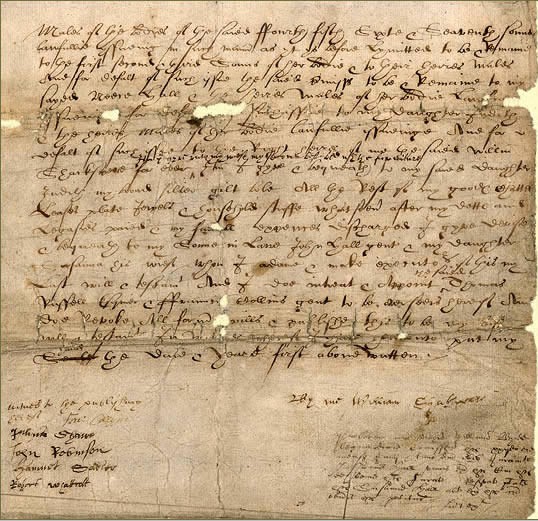

Millions and billions of dollars pass through revocable trusts in Florida to beneficiaries, family members, in-laws and even outlaws. But many people mis-understand what a revocable trust is. This is your easy-2-understand guide. We have previously written about these estate planning documents, or entities (click HERE to read more). Now, let’s go a bit deeper. What is a Revocable Trust Florida? Background — why do I care? You need to know about revocable trusts for 2 main reasons. First, everyone in Florida has them ! (Mostly everyone !!). They work just like a will….sort of ! They are part of a Florida resident’s estate plan. They can work with a pourover will and also a power of attorney. Most of the time, someone has a will that leaves most everything to their revocable trust. Then, the revocable trust gathers assets and administers those assets according to the trust document. The trust document may, for example, distribute everything right then and there. Or, keep money in trust for years and years to come. (Some beneficiaries may never get a dime. And some may not see any money for decades unless you modify the trust. Want to modify a trust? Start by reading this law. ) What else do I need to know about what is a revocable trust Florida? What is a revocable trust ? Second, that’s how a lot of inheritances are left or created. Through one of these trusts. While most of the time a lawyer writes a trust. […]